I Owe the IRS Back Taxes HELP!

- 0 Comments

- IRS Back Taxes, IRS Tax Attorney, IRS Tax Debt, IRS Tax Relief, Offer in Compromise, Ohio Tax Attorney, Tax Settlement

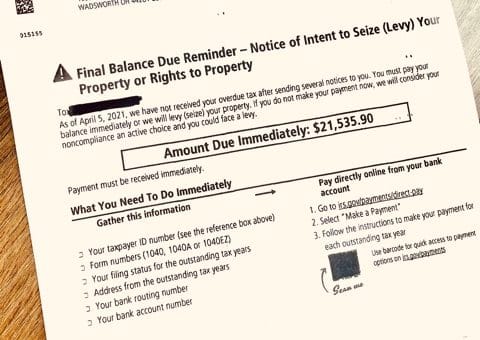

Getting a notice in the mail that you owe the IRS back taxes is scary. That moment when you say to yourself, "I owe the IRS back taxes" and you don't even open the envelope because you already know what is inside. You may feel like you are alone and have no way out - after all, it is...

Read More