How to Get IRS Penalties Waived

- Posted by Joshua Sells

- On April 28, 2021

- first-time penalty abatement, how to get irs penalties waived, how to get the irs to remove penalties and interest, how to reduce irs penalties, irs abatement, irs abatement of penalties, irs penalties, irs penalties waived, irs penalty, IRS Penalty Abatement, irs penalty waiver, irs tax penalty, late filing penalty, late payment penalty, penalties and interest, penalty abatement, reasonable cause, reduce tax penalties, tax penalties and interest, underpayment penalty

How to get IRS penalties waived

How to Get IRS Penalties Waived Using an IRS Computer Glitch to Your Advantage

You’ve probably heard about first time penalty abatement with the IRS. It’s where you can call the IRS and with a 5-minute phone call you can have certain penalties waived.

But did you know there’s a trick to do get your IRS penalties waived twice?

That’s right! You can use penalty abatement (twice) to get thousands of dollars knocked off your balance. And knowing this IRS computer code glitch can be used to your advantage to get even more IRS penalties waived!

Check it out below, or watch my video on YouTube.

Late Payment and Late Filing IRS Penalties

The IRS late filing penalty is a maximum of 25% (failure-to-file penalty). Every month that your tax return is late, the IRS is going to charge you 5% of the balance due. The IRS late payment penalty is also a maximum of 25% (failure-to-pay penalty). Every month that you have a balance, the IRS is going to charge you 0.5% of the balance due. Combined, you are looking at almost 50% in penalties that the IRS can whack you with. It is short of 50% as the maximum monthly penalty for both penalties in a single month is 5%.

If you have a balance of $10,000 – you are looking at almost $5,000 more in penalties. And that doesn’t include the interest that the IRS charges either.

Types of Penalty Abatement

There are two types of penalty abatement. Both types will require that you have all of your tax returns filed (at least the last six tax returns). You must also ensure you (1) do not have a back tax balance, or (2) have an IRS installment agreement.

The first, and easiest, type of penalty abatement is the first time penalty abatement. For the year that you are requesting to have penalties abated (the IRS will only abate penalties on a tax-year by tax-year basis), look back at the three years before. If there are no penalties in those three years, then you qualify for IRS First-Time Penalty abatement. The IRS will literally waive penalties over the phone – and there is no dollar limit!

The second, and a bit more challenging, is the reasonable cause penalty abatement. For over the phone, there is generally a $1,000 dollar limit to what the IRS will abate. Further, you must (1) have a good reason why the return was late or the tax wasn’t paid and (2) show that you did what you could do to prevent the issue. If the amount is over $1,000, then you will need to write to the IRS.

How to Use the IRS Penalty Abatement Computer Program to your Advantage

IRS Abatement of Penalties

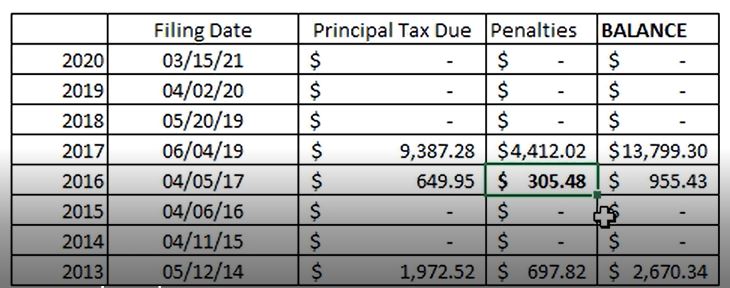

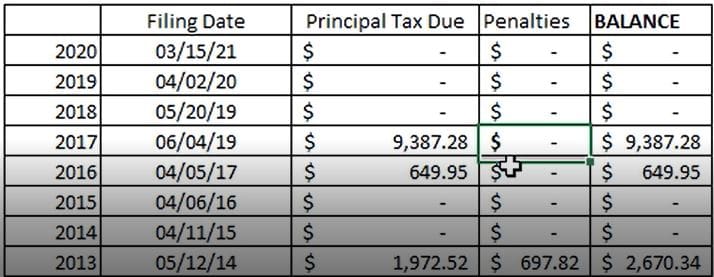

Let’s say that you owe the IRS for 2017, 2016, and 2015 and your penalties are as shown on the graph. Also, assume all returns have been filed, an installment agreement is in place, and that there were penalties in 2012 (although that balance has since been paid off).

Step 1 – Reasonable Cause Penalty Abatement – 2016 $305.48

What we’re trying to do is get to that $4,412.02 penalty balance – that’s the big one. First-time penalty abatement won’t work on that year (2017) because if you look back at the three prior years (2016, 2015, and 2014), there is a penalty balance present (2016). We also can’t do reasonable cause penalty abatement over the phone for 2017, because it is above the general limit of around $1,000 for reasonable cause abatement by phone. We could write in – but that would take a long time and would be more heavily scrutinized.

So, we do a reasonable cause penalty abatement for 2016 over the phone instead.

Penalty Abatement Request

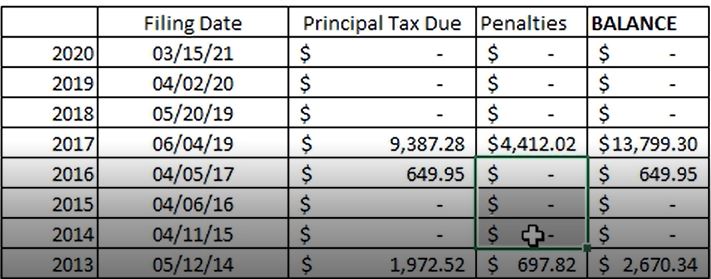

Now look at what we have. The IRS grants us the reasonable cause penalty abatement for 2016. We had a good reason, had clear start-dates/end-dates, and demonstrated that the taxpayer tried to mitigate the issue.

Step 2 – First Time Penalty Abatement – 2017 $4,412.02

So here is where the “computer glitch” comes into play. The first-time abatement is a one-time abatement. There will be a code that appears on your IRS transcript (generally, code 021 or 020). This tells the computer that an abatement of penalties has occurred and it was a first-time abatement. The IRS designed the computer this way, so you couldn’t just first-time abate all of your penalties.

However, the computer codes reasonable cause penalty abatement differently. It is generally coded as 062!

So, what we will now do is wait for the reasonable cause abatement to post (about 2-3 weeks). Then, we will call the IRS and request a first-time abatement of the 2017 penalty in the amount of $4,412.02.

The computer will scan the three preceding years to see if there are any penalties OR removed penalty codes 021/020. Voila. We did our removal as a reasonable cause abatement (which is coded as 062). So, the computer does not see any penalties AND the computer does not see codes 021/020.

First-time abatement granted. $4,412.02 wiped off the account.

First Time Penalty Abatement IRS

Using this IRS “computer glitch” we were able to get two penalty abatements, saving almost $5,000! And yes, this is a real case with real numbers.

If you would like to talk with an experienced tax attorney about your IRS back tax or penalty abatement, call 330-331-7611 or request a free case analysis online today.